Suze Orman Estate Planner: Your Ultimate Guide To Securing Your Legacy

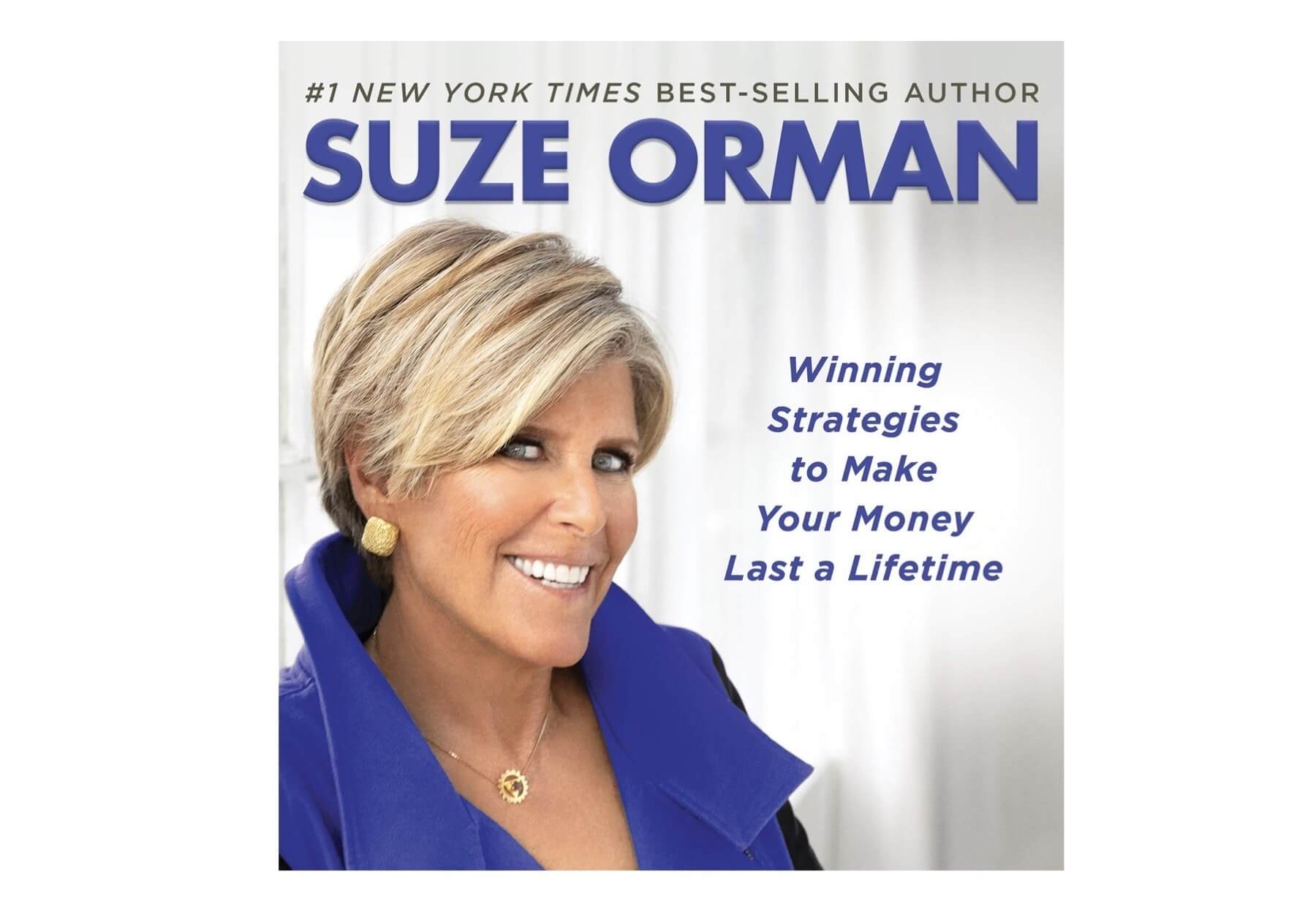

When it comes to estate planning, Suze Orman is more than just a name—she’s a powerhouse in the financial world. Her expertise and no-nonsense approach have made her a trusted advisor for millions. Whether you're a young professional or a seasoned investor, Suze Orman’s estate planning strategies can help you secure your legacy and protect what matters most.

Imagine this: you’ve worked hard all your life, built a business, accumulated wealth, and now you want to ensure that everything you’ve built goes to the right people. That’s where Suze Orman comes in. She’s not just about managing money; she’s about creating a plan that lasts long after you’re gone. Her advice isn’t just for the rich—it’s for anyone who wants to take control of their financial future.

So, why should you care about estate planning? Because life is unpredictable, and having a solid plan in place can make all the difference for your loved ones. In this article, we’ll dive deep into Suze Orman’s estate planning strategies, uncover her tips for protecting your assets, and explore how you can create a plan that aligns with your goals. Let’s get started!

- Boise State College Football Playoff The Story Of Perseverance Passion And Power

- Who Is G Herbo Signed To A Deep Dive Into The Chicago Rappers Record Deal

Table of Contents:

- Suze Orman: A Brief Biography

- Why Estate Planning Matters

- Suze Orman’s Top Estate Planning Tips

- Trusts vs. Wills: What’s the Difference?

- Planning for Digital Assets

- Tax Considerations in Estate Planning

- Charitable Giving and Estate Planning

- Common Estate Planning Mistakes to Avoid

- How to Get Started with Estate Planning

- Resources for Estate Planning

Suze Orman: A Brief Biography

Suze Orman is more than just a financial expert; she’s a trailblazer who has transformed the way people think about money. Born in Chicago in 1951, Suze grew up in a working-class family and faced financial challenges early in life. Her journey from a struggling waitress to a best-selling author and TV personality is nothing short of inspiring.

Here’s a quick look at her background:

- What Languages Are Spoken In Greenland A Deep Dive Into The Linguistic Landscape

- Crumble Cookies Flavors Of The Week A Sweet Adventure You Dont Want To Miss

| Full Name | Suze Orman |

|---|---|

| Birthdate | June 30, 1951 |

| Profession | Financial Advisor, Author, TV Host |

| Education | Bachelor’s Degree in Social Work from the University of Illinois |

| Notable Works | The Courage to Be Rich, Women & Money, The 9 Steps to Financial Freedom |

Suze’s rise to fame began when she started offering financial advice on radio shows. Her straightforward approach and ability to break down complex financial concepts made her a household name. Today, she’s one of the most respected voices in personal finance, and her insights on estate planning are invaluable for anyone looking to protect their assets.

Why Estate Planning Matters

Estate planning isn’t just for the wealthy. It’s for anyone who wants to ensure that their assets are distributed according to their wishes. Think about it: if you don’t have a plan in place, the state could end up deciding who gets what—and that’s not exactly ideal.

Estate planning involves creating a roadmap for your assets, including:

- Real estate

- Bank accounts

- Retirement funds

- Life insurance policies

- Digital assets like social media accounts and domain names

According to a survey by Caring.com, only 48% of Americans have an estate plan in place. That means more than half of us are leaving our loved ones vulnerable to legal battles and financial uncertainty. Don’t let that be you. With Suze Orman’s guidance, you can create a plan that gives you peace of mind.

Suze Orman’s Top Estate Planning Tips

Suze Orman has spent decades helping people navigate the complexities of estate planning. Here are some of her top tips:

Tip #1: Start with a Will

A will is the foundation of any estate plan. It’s a legal document that outlines how you want your assets distributed after you pass away. Suze emphasizes that everyone, regardless of their net worth, should have a will. Without one, your assets could end up in probate court, which can be a long and costly process.

Tip #2: Consider a Trust

While a will is essential, a trust can offer additional protection. A trust allows you to transfer assets to beneficiaries without going through probate. Suze recommends setting up a revocable living trust, which gives you flexibility to make changes while you’re still alive.

Tip #3: Protect Your Digital Assets

In today’s digital age, your online presence is just as important as your physical assets. Suze advises keeping a list of all your digital accounts, including usernames and passwords, and sharing it with a trusted family member or executor. This ensures that your digital legacy is handled with care.

Trusts vs. Wills: What’s the Difference?

One of the most common questions people have about estate planning is the difference between trusts and wills. While both are important, they serve different purposes.

A will is a document that outlines how you want your assets distributed after your death. It’s simple to create and can be updated easily. However, it doesn’t avoid probate, which can be time-consuming and expensive.

A trust, on the other hand, allows you to transfer assets to beneficiaries without going through probate. There are two main types of trusts: revocable and irrevocable. A revocable trust can be changed or revoked at any time, while an irrevocable trust is permanent.

Suze Orman often recommends a revocable living trust for most people because it offers flexibility and avoids probate. However, the best option depends on your specific situation, so it’s always a good idea to consult with a professional.

Planning for Digital Assets

Your digital assets are more valuable than you might think. From social media accounts to online banking, your digital footprint is a crucial part of your estate plan. Suze Orman stresses the importance of creating a digital estate plan to ensure that your online presence is handled properly.

Here are some steps you can take:

- Create a list of all your digital accounts, including usernames and passwords.

- Designate a digital executor to manage your accounts after you pass away.

- Include instructions for how you want your accounts handled (e.g., close them, transfer ownership).

By planning for your digital assets, you can ensure that your online presence is managed with respect and care.

Tax Considerations in Estate Planning

Taxes can eat away at your estate if you’re not careful. Suze Orman advises being mindful of tax implications when creating your estate plan. For example, if you leave a large sum of money to your heirs, they may have to pay estate taxes.

The federal estate tax exemption is currently $12.92 million per individual, but this can change depending on legislation. Suze recommends working with a tax professional to ensure that your estate plan is tax-efficient.

Additionally, consider strategies like gifting during your lifetime to reduce the size of your estate. You can gift up to $17,000 per person annually without incurring gift taxes. This can help you reduce your taxable estate and provide financial support to your loved ones while you’re still alive.

Charitable Giving and Estate Planning

Charitable giving can be a meaningful way to leave a legacy. Suze Orman encourages people to consider including charitable donations in their estate plans. Not only does it benefit the causes you care about, but it can also reduce your taxable estate.

There are several ways to incorporate charitable giving into your estate plan:

- Create a charitable trust that pays income to a charity while providing tax benefits to you and your heirs.

- Leave a bequest to a charity in your will.

- Designate a charity as the beneficiary of a life insurance policy or retirement account.

By including charitable giving in your estate plan, you can make a lasting impact on the world while reducing your tax burden.

Common Estate Planning Mistakes to Avoid

Even the best-laid plans can go awry if you make common estate planning mistakes. Suze Orman has seen it all, and she’s here to help you avoid these pitfalls:

- Not having a will or trust in place.

- Failing to update your estate plan after major life events (e.g., marriage, divorce, birth of a child).

- Not naming a guardian for your minor children.

- Forgetting to designate beneficiaries for retirement accounts and life insurance policies.

- Ignoring digital assets in your estate plan.

By being aware of these mistakes, you can create a more comprehensive and effective estate plan.

How to Get Started with Estate Planning

So, how do you get started with estate planning? Suze Orman recommends taking the following steps:

- Take inventory of your assets, including real estate, bank accounts, investments, and digital assets.

- Decide who you want to inherit your assets and in what amounts.

- Choose an executor or trustee to manage your estate after you pass away.

- Create a will or trust, depending on your needs.

- Consult with an estate planning attorney to ensure that your plan is legally sound.

Remember, estate planning is an ongoing process. As your life circumstances change, so should your estate plan. Regularly review and update your documents to ensure they reflect your current wishes.

Resources for Estate Planning

There are plenty of resources available to help you with estate planning. Here are a few that Suze Orman recommends:

- LegalZoom: A popular online platform for creating legal documents like wills and trusts.

- Nolo: Offers a wide range of books and resources on estate planning.

- AARP: Provides free estate planning resources for members.

Additionally, consider working with a certified financial planner or estate planning attorney to ensure that your plan is tailored to your specific needs.

Kesimpulan

Estate planning may not be the most exciting topic, but it’s one of the most important things you can do for yourself and your loved ones. With Suze Orman’s guidance, you can create a plan that protects your assets, reduces taxes, and ensures that your legacy lives on.

Remember to start with a will, consider a trust, and don’t forget about your digital assets. Avoid common mistakes, update your plan regularly, and seek professional advice when needed. By taking these steps, you can secure your financial future and give your loved ones peace of mind.

So, what are you waiting for? Start planning today and take control of your legacy. And if you found this article helpful, don’t forget to share it with your friends and family. Together, we can all build a brighter financial future!

- Exploring The Best Mexican Food In Waco A Flavorful Adventure

- Mastering Mypascoconnect Your Ultimate Guide To My Student Success

Here's Why Suze Orman Says There Has Never Been So Many Serious

Suze Orman 3 Things To Do To Start Retirement Planning in 2025

HerMoney Podcast Episode 205 Suze Orman On Coronavirus, Your