Sam Bankman-Fried FTX Office November 8 2022: The Day Everything Changed

November 8, 2022, was a pivotal day for the crypto world, particularly for Sam Bankman-Fried and FTX. It was the day when the cracks in the empire began to show, and the world got its first glimpse into the chaos that would eventually unravel one of the biggest names in cryptocurrency. This wasn’t just another Tuesday; it was the beginning of the end for FTX as we knew it. So, buckle up because this story is wild, and you’re about to dive deep into the drama that shocked the financial world.

Sam Bankman-Fried, or SBF as he’s often called, was once the golden boy of crypto. He built an empire that seemed unstoppable, but like many great stories, this one has a dark twist. On November 8, 2022, the FTX office became the epicenter of a crisis that would send shockwaves through the industry. This wasn’t just about money; it was about trust, ambition, and the fragility of the systems we rely on.

What happened that day? Why did it matter? And how did it all go so wrong? These are the questions we’ll explore in this article. But before we get into the nitty-gritty, let’s set the stage. This isn’t just a story about crypto; it’s a story about human nature, greed, and the consequences of unchecked power. Let’s dive in, shall we?

- Unveiling The Inspiring Journey Of Enoch Huerta A Story That Resonates

- Exploring The Best Food Court Midway Airport Has To Offer

Who is Sam Bankman-Fried?

Before we talk about the office and the events of November 8, 2022, it’s important to know who Sam Bankman-Fried is. SBF wasn’t just some guy who decided to dabble in crypto. He was a mathematical genius, a former trader at Jane Street Capital, and a philanthropist with big dreams. He co-founded Alameda Research, a trading firm, and later FTX, a cryptocurrency exchange that quickly became one of the biggest in the world.

But behind the flashy headlines and the billionaire status was a man with a vision—or so it seemed. SBF positioned himself as a champion of effective altruism, pledging to give away most of his wealth to charity. He was the face of crypto, the guy who could make the impossible possible. Or so we thought.

Sam Bankman-Fried's Early Life and Career

Let’s rewind a bit. Sam Bankman-Fried was born on February 6, 1992, in Palo Alto, California. He grew up in a family of academics; his dad was a law professor at Stanford, and his mom taught accounting. From an early age, SBF was drawn to math and problem-solving. After graduating from MIT with a degree in physics, he joined Jane Street Capital, where he made a name for himself as a brilliant trader.

- Exploring The Best Mexican Food In Waco A Flavorful Adventure

- Paul Rodriguez Jr The Skateboarding Legends Journey

But SBF wasn’t content with just trading. He saw an opportunity in the crypto market, a space that was ripe for disruption. In 2017, he co-founded Alameda Research, a quantitative trading firm that focused on crypto. It was here that he laid the groundwork for what would become FTX, a platform that promised to revolutionize the industry.

The Rise of FTX

FTX wasn’t just another crypto exchange. It was designed to be different, offering a range of innovative products and services that set it apart from its competitors. From futures contracts to tokenized stocks, FTX offered traders everything they could dream of—and more. It quickly gained a reputation as one of the most sophisticated platforms in the industry.

But FTX wasn’t just about trading. It was also about community. SBF and his team worked hard to build a loyal following, hosting events, sponsoring sports teams, and even launching a basketball arena. They were everywhere, and it seemed like nothing could stop them. Or so it seemed.

Key Features of FTX

- Innovative trading products

- Tokenized stocks and ETFs

- Advanced leverage options

- Strong focus on customer experience

- Global reach with multiple regulatory approvals

These features made FTX a magnet for traders and investors alike. But as we’ll see, this rapid growth came at a cost.

November 8, 2022: The Day Everything Changed

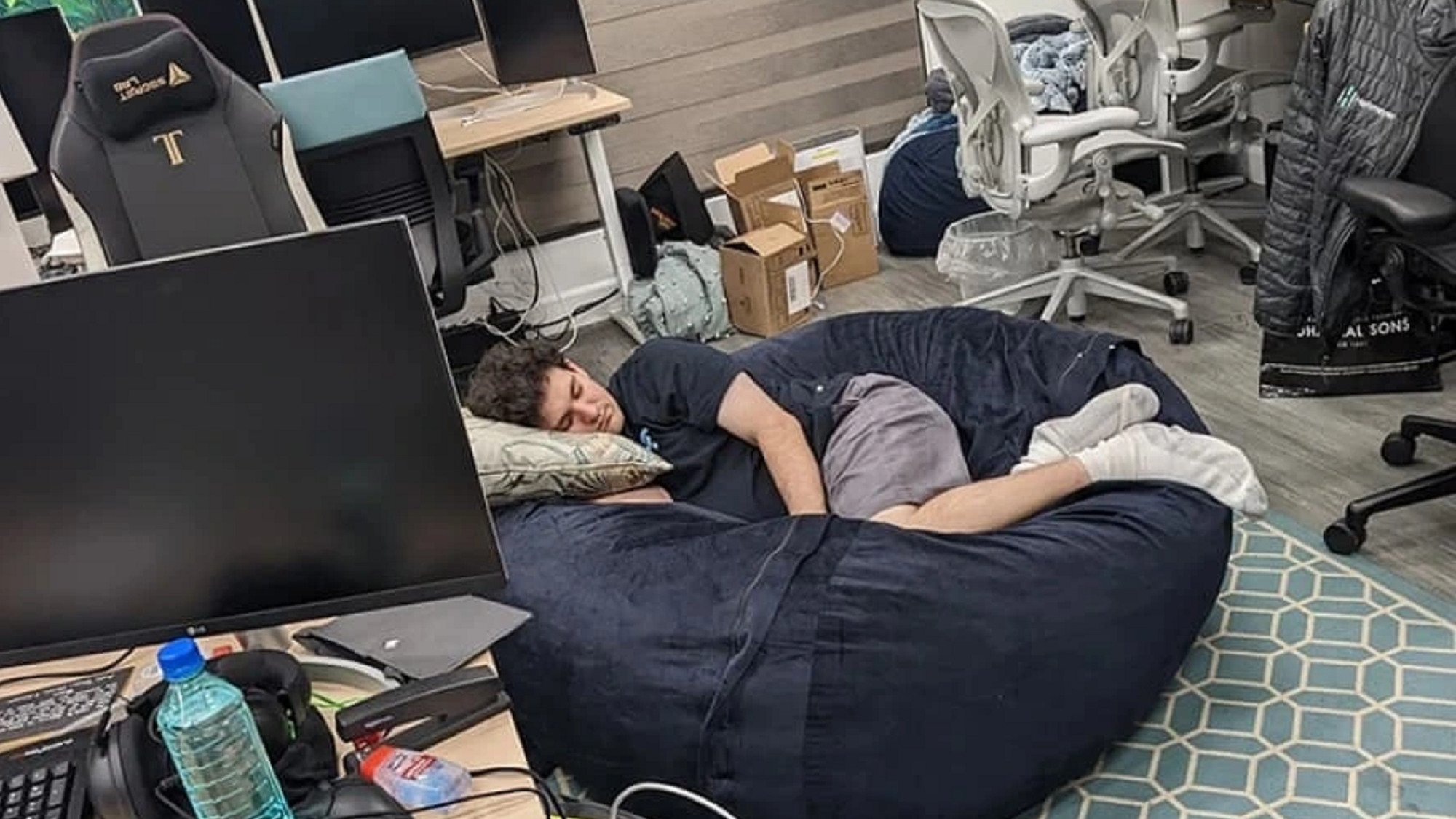

Now, let’s talk about the day that changed everything. On November 8, 2022, the FTX office was bustling with activity. Employees were going about their day, unaware of the storm that was brewing. But behind the scenes, things were unraveling fast.

It all started with a tweet. Crypto exchange Binance announced that it was selling its holdings of FTT, the native token of FTX. This triggered a massive sell-off, causing the price of FTT to plummet. Panic spread through the market, and users began withdrawing their funds en masse. FTX was bleeding cash, and there was no way to stop it.

The FTX Office on November 8, 2022

Inside the FTX office, the atmosphere was tense. Employees were glued to their screens, watching the numbers fall. SBF was on the phone, trying to secure a lifeline. But the damage was done. The market had lost faith in FTX, and there was no turning back.

What made matters worse was the revelation that Alameda Research, FTX’s sister company, had borrowed heavily against FTT. This created a conflict of interest and raised serious questions about the integrity of the platform. It was a house of cards, and it was collapsing fast.

What Happened Next?

Over the next few days, the situation spiraled out of control. Binance briefly considered a bailout but ultimately backed out, citing regulatory concerns. FTX filed for bankruptcy on November 11, 2022, leaving thousands of users and investors stranded. The once-mighty empire was no more.

But the fallout didn’t stop there. Investigations began, and the truth started to come out. It turned out that FTX had been using customer funds to prop up Alameda Research, a move that violated basic principles of financial integrity. SBF, once the golden boy of crypto, was now the subject of scrutiny and criticism.

The Fallout

- FTX files for bankruptcy

- Investigations reveal misuse of customer funds

- SBF faces allegations of fraud and mismanagement

- Global regulators step in to investigate

The crypto world was shaken to its core. Trust, the very foundation of the industry, had been betrayed. And SBF, the man who promised to change the world, was at the center of it all.

Sam Bankman-Fried: The Aftermath

So, what happened to SBF? After FTX’s collapse, he became a pariah in the crypto community. Investigations by the SEC and DOJ revealed a web of deceit and mismanagement that left many questioning how it all went so wrong. SBF was eventually arrested and charged with multiple counts of fraud and conspiracy.

But the story doesn’t end there. SBF has maintained his innocence, claiming that the collapse was the result of market forces beyond his control. Whether or not this is true remains to be seen, but one thing is certain: the crypto world will never be the same.

Lessons Learned

The collapse of FTX serves as a cautionary tale for the entire industry. It highlights the importance of transparency, accountability, and regulatory oversight. Here are some key takeaways:

- Transparency is crucial in the crypto space

- Regulation is necessary to protect users and investors

- Conflicts of interest can lead to catastrophic failures

- Trust must be earned and maintained

These lessons are important not just for the crypto industry but for all of us. The FTX saga is a reminder that even the brightest minds can make mistakes, and that trust is the most valuable currency of all.

The Future of Crypto

So, where does the crypto industry go from here? The collapse of FTX was a wake-up call for many, prompting calls for greater regulation and oversight. While some see this as a necessary step, others worry that it could stifle innovation.

One thing is clear: the industry needs to rebuild trust. This means being more transparent, more accountable, and more focused on the needs of users and investors. It’s a tall order, but one that’s essential for the long-term success of crypto.

What’s Next for Sam Bankman-Fried?

As for SBF, his future remains uncertain. He faces a long legal battle, with the potential for significant prison time if convicted. But even if he’s found guilty, the story of FTX will live on as a cautionary tale for generations to come.

Will SBF ever make a comeback? Only time will tell. But one thing is certain: the crypto world will always remember the rise and fall of Sam Bankman-Fried.

Conclusion

November 8, 2022, was a day that changed the crypto world forever. It was the day when the cracks in FTX’s empire began to show, leading to one of the biggest collapses in financial history. The story of Sam Bankman-Fried is a reminder of the dangers of unchecked power and the importance of trust in the financial world.

As we move forward, it’s important to learn from the mistakes of the past. The crypto industry has a chance to rebuild, to become stronger and more resilient. But this will only happen if we remain vigilant, transparent, and accountable.

So, what do you think? Do you believe in the future of crypto? Or do you think the industry is doomed to repeat its mistakes? Let us know in the comments below, and don’t forget to share this article with your friends. Together, we can keep the conversation going and help shape the future of finance.

Table of Contents

- Sam Bankman-Fried FTX Office November 8 2022: The Day Everything Changed

- Who is Sam Bankman-Fried?

- Sam Bankman-Fried's Early Life and Career

- The Rise of FTX

- Key Features of FTX

- November 8, 2022: The Day Everything Changed

- The FTX Office on November 8, 2022

- What Happened Next?

- The Fallout

- Sam Bankman-Fried: The Aftermath

- Lessons Learned

- The Future of Crypto

- What’s Next for Sam Bankman-Fried?

- Conclusion

- Who Is The Founder Of Nickelodeon The Untold Story Behind The Iconic Channel

- Sam Reigel The Journey Achievements And Legacy Of A True Business Titan

Sam BankmanFried's lawyers renew claim that the FTX founder can't

Sam BankmanFried Der unglaubliche Aufstieg und Fall des FTXGründers

Sam BankmanFried Interesting facts and how his FTX collapsed