Unlocking The Power Of DCF My Access: Your Gateway To Financial Insights

Have you ever wondered how companies are valued in the world of finance? Well, let me tell you, it's not just about guessing or pulling numbers out of thin air. DCF my access is your golden ticket to understanding the nitty-gritty of financial valuation. It’s like having a secret decoder ring for the stock market. Whether you're an investor, a finance enthusiast, or just someone curious about how businesses are valued, DCF my access has got your back. So, buckle up, because we’re diving deep into the fascinating world of Discounted Cash Flow (DCF) analysis.

Imagine this: you're sitting in a boardroom, surrounded by suits, and everyone's throwing around terms like "DCF analysis" and "free cash flow." You nod along, pretending to understand, but inside, you're screaming, "What in the world is a DCF?" Well, not anymore. This article will demystify DCF my access for you, breaking it down into bite-sized chunks that even your grandma could understand. No more feeling out of place in financial conversations.

Now, you might be thinking, "Why should I care about DCF my access?" Great question! In today’s world, where financial literacy is more important than ever, understanding DCF is like having a superpower. It helps you make informed decisions, whether you're buying stocks, evaluating a business, or just trying to impress your friends at a dinner party. So, let’s get started and uncover the secrets of DCF my access.

- Man Missing In Nashville The Story That Keeps Everyone On Edge

- Magic Johnson Wife The Remarkable Journey Of Cookie Johnson

What is DCF My Access and Why Should You Care?

First things first, let’s break down what DCF my access actually means. DCF stands for Discounted Cash Flow, and it’s a method used to estimate the value of an investment based on its future cash flows. Think of it like a crystal ball that predicts how much money a business will generate in the future. DCF my access gives you the tools and insights to perform this magical calculation.

Here's the deal: when you invest in a company, you're essentially betting on its ability to generate cash in the future. But how do you know if that company is worth the money you're about to throw at it? That's where DCF my access comes in. It helps you figure out the present value of those future cash flows, giving you a clearer picture of whether the investment is worth it.

Breaking Down the DCF Formula

Now, let’s get into the nitty-gritty of the DCF formula. Don’t worry, I promise it won’t be too math-heavy. The basic formula looks like this:

- Unveiling The Inspiring Journey Of Enoch Huerta A Story That Resonates

- How Old Are Tim Wakefields Children A Deep Dive Into The Life Of The Wakefield Family

DCF = CF1 / (1+r)^1 + CF2 / (1+r)^2 + ... + CFn / (1+r)^n

Let’s break it down:

- CF = Cash Flow (the amount of money the business is expected to generate in a given year)

- r = Discount Rate (this represents the risk or opportunity cost of investing in the business)

- n = Number of Years (how far into the future you're projecting)

Think of the DCF formula as a recipe for financial success. Just like baking a cake, you need the right ingredients and the right steps to get the perfect result. By plugging in the numbers, you can estimate the value of a business today based on its future cash flows. Pretty cool, right?

Why DCF My Access is a Game-Changer

So, why is DCF my access such a big deal in the world of finance? Well, it’s one of the most reliable methods for valuing businesses. Unlike other valuation methods that rely on market multiples or comparables, DCF my access focuses on the actual cash a business is expected to generate. This makes it a more accurate and forward-looking approach.

Here are a few reasons why DCF my access is a game-changer:

- It provides a detailed view of a company’s financial health

- It accounts for future growth and risks

- It’s customizable, allowing you to adjust assumptions based on your analysis

- It helps you make data-driven investment decisions

Whether you're a seasoned investor or just starting out, DCF my access gives you the confidence to make smart financial moves. It’s like having a financial GPS that guides you through the complexities of the market.

How to Use DCF My Access in Real Life

Talking about DCF my access is one thing, but how do you actually use it in real life? Let me walk you through a practical example. Imagine you’re considering investing in a tech startup. The company is expected to generate $1 million in cash flow next year, with a growth rate of 10% for the next five years. The discount rate is 12%. How do you calculate the value of this investment?

Here’s how you do it:

DCF = $1,000,000 / (1+0.12)^1 + $1,100,000 / (1+0.12)^2 + ... + $1,610,510 / (1+0.12)^5

By crunching the numbers, you’ll get an estimated value of the company. This gives you a clearer picture of whether the investment is worth it or not. Pretty neat, huh?

Common Misconceptions About DCF My Access

Like any financial tool, DCF my access comes with its fair share of misconceptions. Let’s bust a few of them:

1. DCF is Only for Big Corporations

Wrong! DCF my access can be applied to businesses of all sizes, from startups to multinational corporations. It’s all about the data and assumptions you use in your analysis.

2. DCF is Too Complicated

Sure, the math might look intimidating at first, but with the right tools and resources, anyone can master DCF my access. There are plenty of online calculators and templates to help you get started.

3. DCF is Infallible

Not true! Like any financial model, DCF my access is only as good as the assumptions you put into it. If your assumptions are off, your results will be too. That’s why it’s important to use reliable data and stay updated with market trends.

Advantages of Using DCF My Access

Now that we’ve cleared up some misconceptions, let’s talk about the advantages of using DCF my access:

- It provides a comprehensive view of a company’s financial performance

- It accounts for future growth and risks, giving you a more accurate valuation

- It’s customizable, allowing you to tailor the analysis to your specific needs

- It helps you make informed investment decisions, reducing the risk of losses

Whether you're evaluating a potential acquisition or assessing the value of your own business, DCF my access is an invaluable tool in your financial arsenal.

Challenges and Limitations of DCF My Access

While DCF my access is a powerful tool, it’s not without its challenges and limitations. Here are a few things to keep in mind:

1. Sensitivity to Assumptions

DCF my access is highly sensitive to the assumptions you make about future cash flows and discount rates. A small change in these assumptions can significantly impact your results.

2. Requires Accurate Data

Garbage in, garbage out. If you use inaccurate or incomplete data, your DCF analysis will be flawed. It’s crucial to gather reliable data and stay updated with market trends.

3. Ignores Non-Financial Factors

DCF my access focuses solely on financial metrics, ignoring non-financial factors like brand reputation, management quality, and market conditions. While these factors are harder to quantify, they can still impact a company’s value.

Tools and Resources for Mastering DCF My Access

Now that you know the ins and outs of DCF my access, let’s talk about the tools and resources you can use to master it:

1. Excel Templates

Excel is a powerful tool for performing DCF analysis. There are plenty of free and paid templates available online that can help you get started.

2. Financial Modeling Courses

If you want to take your DCF skills to the next level, consider enrolling in a financial modeling course. These courses will teach you the ins and outs of DCF analysis and other financial modeling techniques.

3. Online Calculators

For those who prefer a more hands-off approach, there are plenty of online DCF calculators available. These tools allow you to input your data and assumptions, and they’ll do the calculations for you.

Real-World Examples of DCF My Access in Action

Let’s take a look at some real-world examples of DCF my access in action:

1. Tesla’s Valuation

When Tesla’s stock price skyrocketed in recent years, many investors questioned whether the company was overvalued. DCF my access was used to analyze Tesla’s future cash flows and determine whether the stock price was justified.

2. Netflix’s Growth Strategy

Netflix has been using DCF my access to evaluate its growth opportunities and make strategic decisions. By projecting future cash flows, the company can determine which markets to enter and which content to invest in.

3. Apple’s Acquisition of Beats

When Apple acquired Beats for $3 billion, DCF my access was used to assess the value of the acquisition. By analyzing Beats’ future cash flows, Apple could determine whether the acquisition was a good investment.

Conclusion: Take Action and Unlock Your Financial Potential

So, there you have it – everything you need to know about DCF my access. From understanding the basics of the DCF formula to mastering the tools and resources available, you’re now equipped to unlock the power of financial valuation. Whether you're an investor, a business owner, or just someone curious about the world of finance, DCF my access is your key to success.

Now, it’s your turn to take action. Start exploring the world of DCF analysis, experiment with different tools and resources, and make informed financial decisions. And don’t forget to share this article with your friends and colleagues – let’s spread the financial literacy love!

Remember, the world of finance is constantly evolving, and staying informed is the key to success. Keep learning, keep growing, and most importantly, keep DCF-ing!

Table of Contents

- What is DCF My Access and Why Should You Care?

- Breaking Down the DCF Formula

- Why DCF My Access is a Game-Changer

- How to Use DCF My Access in Real Life

- Common Misconceptions About DCF My Access

- Advantages of Using DCF My Access

- Challenges and Limitations of DCF My Access

- Tools and Resources for Mastering DCF My Access

- Real-World Examples of DCF My Access in Action

- Conclusion: Take Action and Unlock Your Financial Potential

- Exploring The Best Food Court Midway Airport Has To Offer

- Is Angelina Jolie Dating The Latest Scoop You Need To Know

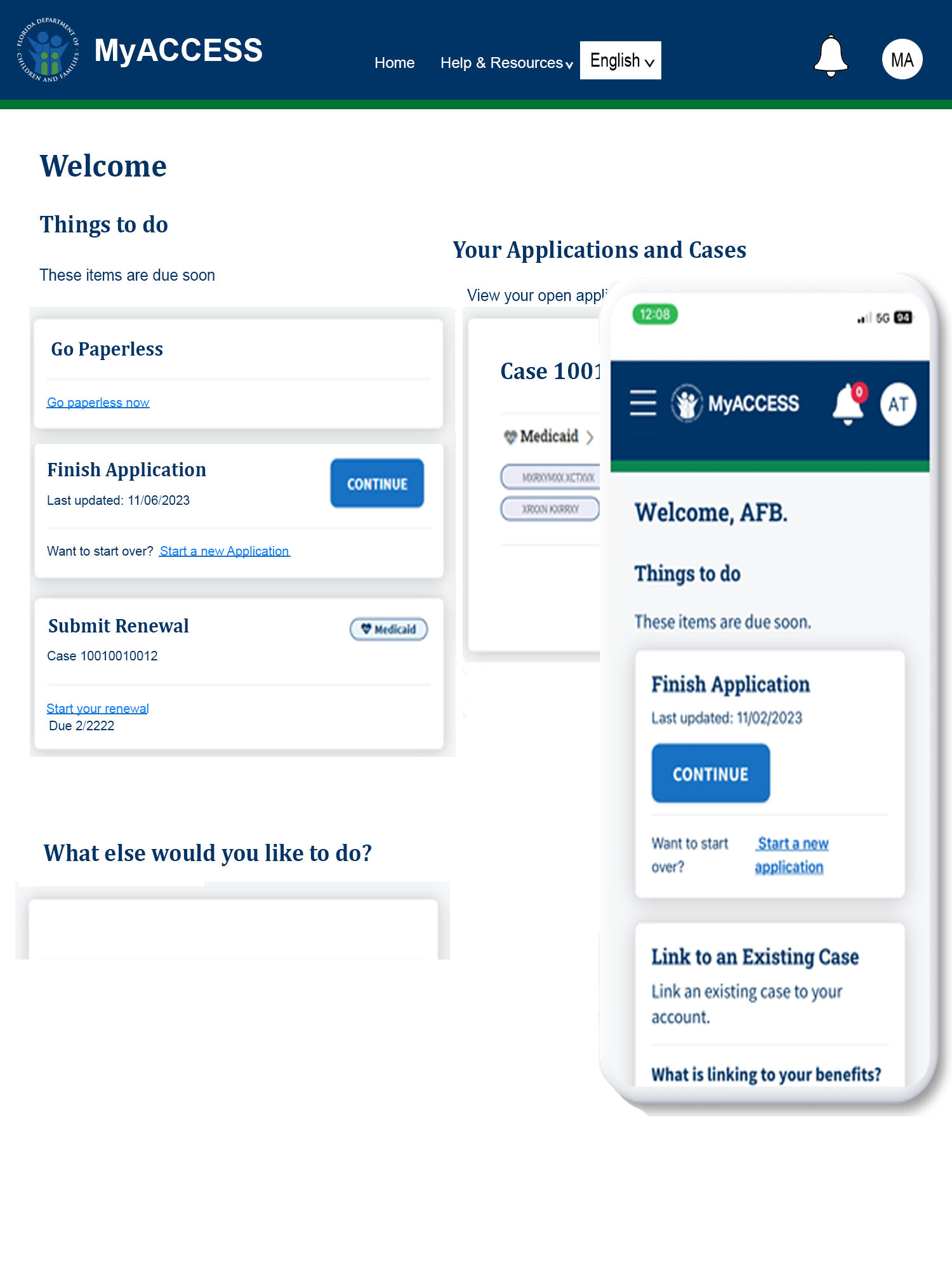

MyACCESS Portal Information Florida DCF

Discounted Cash Flow (DCF) Model Free Excel Template, 53 OFF

My ACCESS Account Login and Account Status Guide Florida